How to Achieve Profitability in Virtual Care

A deep dive into cost models and unit economics in telehealth

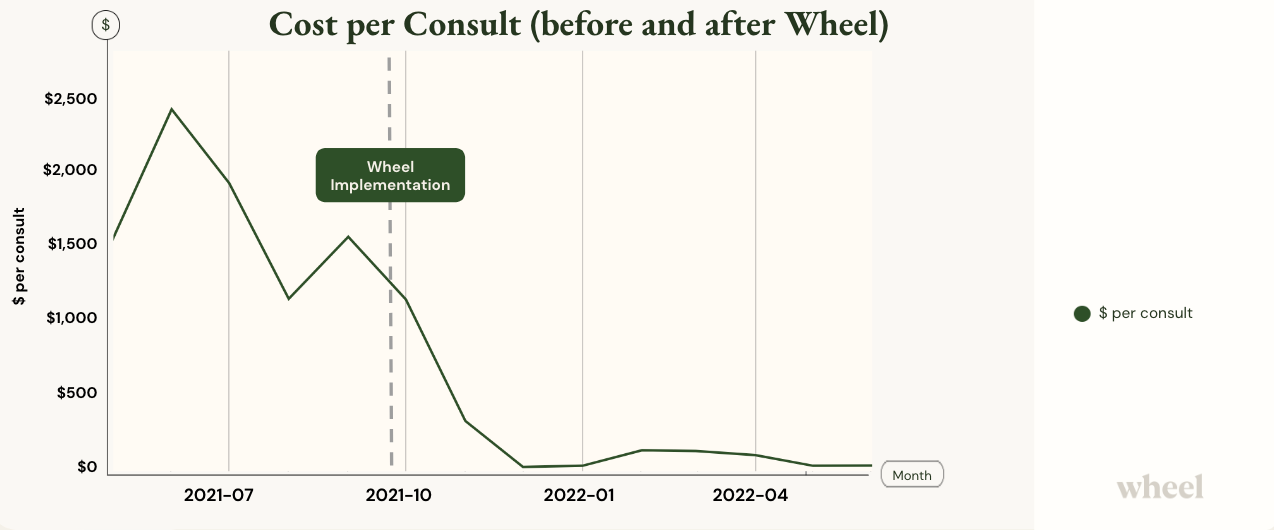

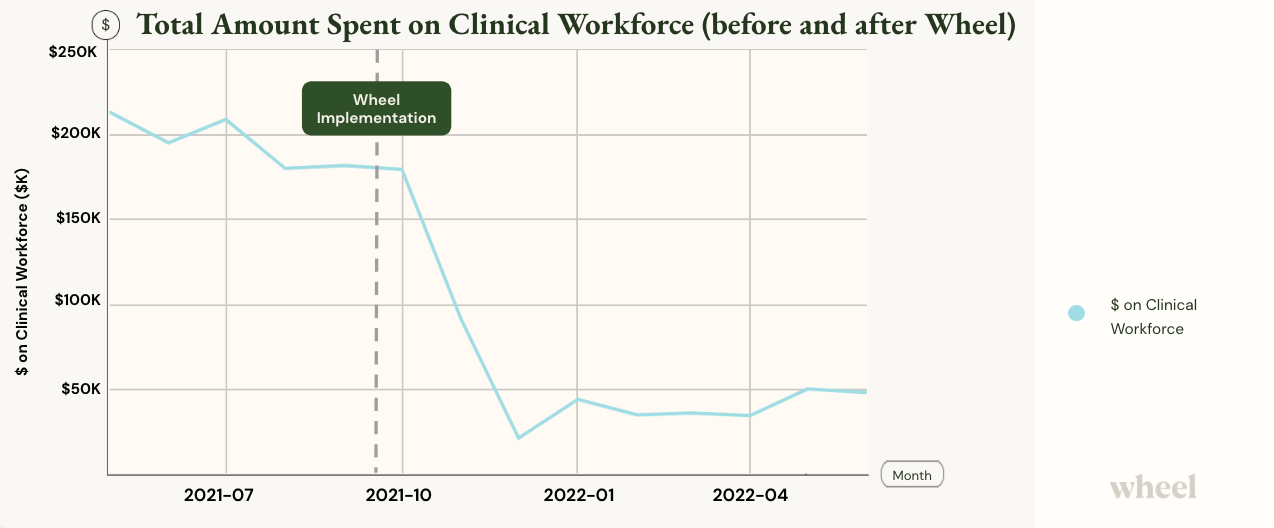

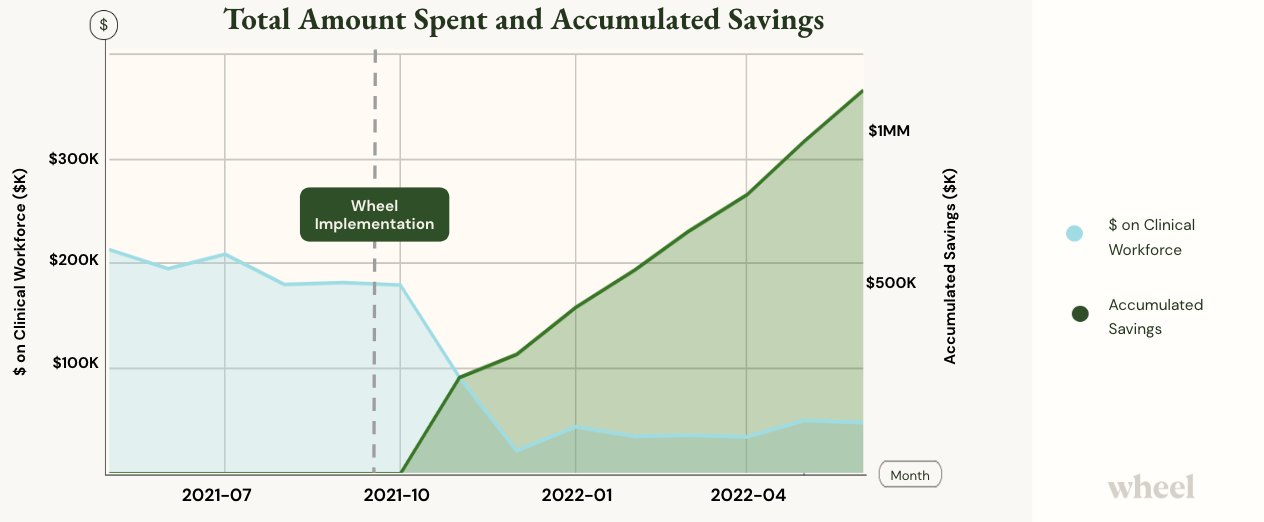

An examination of Wheel’s proprietary data revealed a client savings of 93% per patient visit on clinician staffing expenses since November of 2021 — a savings totaling more than $1.2 million over 7 months. In June of 2022 alone, this client saved $151K.

Even the Wheel team was surprised by these figures. After digging in with our business intelligence team, we realized the importance of sharing this story not only with our broader org, but also outside the Wheel walls for companies in the business of virtual care.

So many companies struggle to unlock the ROI in telehealth. While we can’t say we’ve completely solved the puzzle, we know this data is a start. We believe that healthcare won’t be solved in silos, and sharing what’s worked can help us all build a better healthcare future.

To understand how and why this client achieved such success, we’ll first need to break down how revenue and unit economics work in telehealth. We’ll also review the challenges in reaching a profitability break-even point. And finally, we’ll dig into the real-life client example inspiring this post and break down the data points of their success.

We hope you find it helpful!

Building a world-changing business

“To be a world-changing service, you have to build a world-changing business.”

One of our operations leaders shared this idea with our full team this year. She adopted this idea from a mentor. On the surface, it’s simple. But healthcare is a clear illustration of how non-world-changing businesses have further exacerbated the barriers to access and feasibility of delivering quality care. Unfortunately, world-changing services in healthcare are few and far between.

With so many well-meaning companies out there, why is that?

Because access to care is expensive, and delivering healthcare in this country is really hard to do. It’s fragmented. It’s regulated. And it’s been historically slow and resistant to change.

So, how do companies build world-changing businesses in healthcare?

To figure out how to be a world-changing business in healthcare, we need to talk about economics.

The economics of clinician staffing

Traditional and digital healthcare companies, retailers, and most notably, tech behemoths, have spent years attempting to fix healthcare challenges — and they’ve mostly failed due to profitability problems. (See Haven Healthcare, IBM Watson, Google Health, Proteus, and more.)

Virtual care complicates matters further by upending the traditional working model for clinicians, and companies are forced to evaluate whether traditional staffing makes sense. (In short, it doesn’t.)

Traditional healthcare staffing is antiquated. It’s built on a 1-to-1 model where an individual clinician works for one hospital or one clinic and clinicians are paid hourly for 8-12 hour shifts. Clinicians are utilized as much as possible based on the volume of patients that day. This model is optimized for in-person care, but not virtual care.

Staffing for virtual care can be the most challenging — and most expensive — piece of the telehealth delivery puzzle. To deliver care in multiple states without breaking the bank, companies must solve for the variability of patient demand.

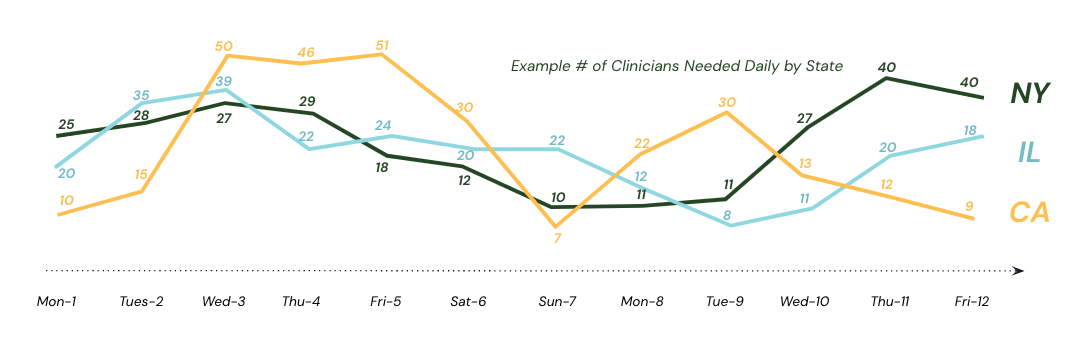

We’ve covered this economic headache in depth, but basically, when building a clinical network yourself, you have to guess at what the right number of clinicians will be. Not only how large your roster should be, but how many clinicians should be staffed on any given day, at any given time, and for each state. It’s nearly impossible to accurately predict the geographic distribution of patients vs. the right distribution of clinician licenses to serve them. This challenge requires time, money, and resources.

In addition, clinicians themselves are also expensive. As highly-skilled and educated specialists, physician assistants, nurse practitioners, and physicians have (well-deserved) high hourly rates. Ultimately, both the telehealth care model and the services become expensive for a company to deliver at scale.

To illustrate this, let’s walk through a hypothetical, yet common, example.

Example 1: SMB Company A

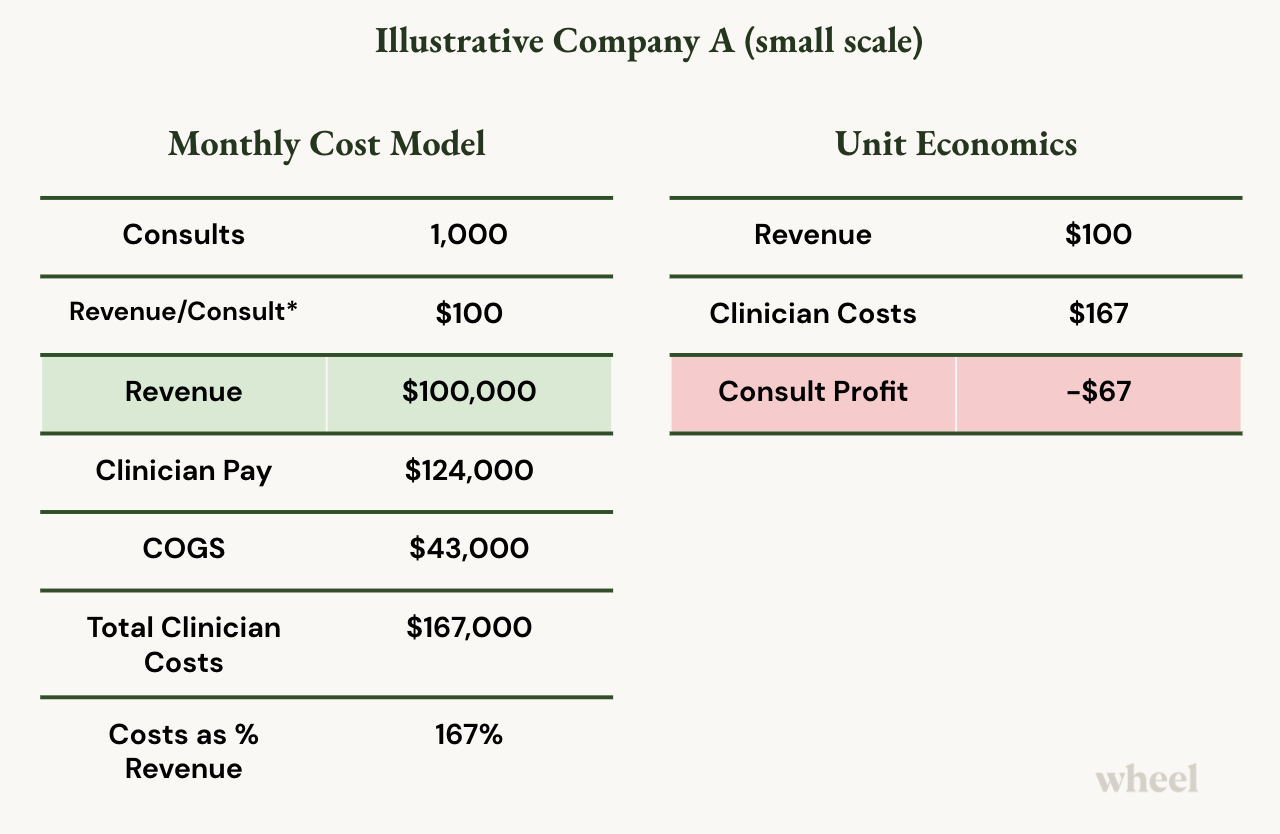

Below we’ve outlined a virtual care cost example for Illustrative Company A.

This example illustrates a typical cost model for a small-to-medium-size business that’s just starting out in virtual care. They are delivering synchronous telehealth visits with a 30-minute SLA (patients are seen within 30-minutes of a request) operating 7 days/week from 7am to 7pm.

Consults: This company aims to service 1,000 patient visits (consults) per month.

Revenue: Their revenue per consult is about $100, so they’re taking in about 100K in revenue per month. *Note this is assuming a payor model for reimbursed visits. If this were cash pay, the revenue would be significantly less.

Clinician Compensation: They spend $124,000 per month for hourly clinician compensation.

Costs of Goods Sold (COGS): In telehealth, COGS may include benefits for full-time employees, clinician licensing and credentialing costs, technology equipment, etc. In this example, this amounts to $43,000 per month.

In this very common scenario, to make $100K in virtual care, the company must spend $167K.

Even though it’s an incredible service this company is providing, it’s extremely expensive, and their unit economics show that for every single consult they provide and create, they lose $67.

Underneath that $67 are the company’s other operating expenses including R&D, G&A, and other headquarter costs.

Additionally, it’s important we underscore that this is a reimbursed example. If this were cash pay (i.e. generating far less than $100 in revenue/consult), the company would be further in the red!

If you are losing $67 before you’ve even touched those costs, this isn’t a world-changing business and you can’t do this very long.

Example 2: Company A at scale

You may be wondering if this economic model resolves itself at scale. In some ways, it does.

The challenge companies still face is in the time it takes to reach a scale that breaks even and becomes profitable.

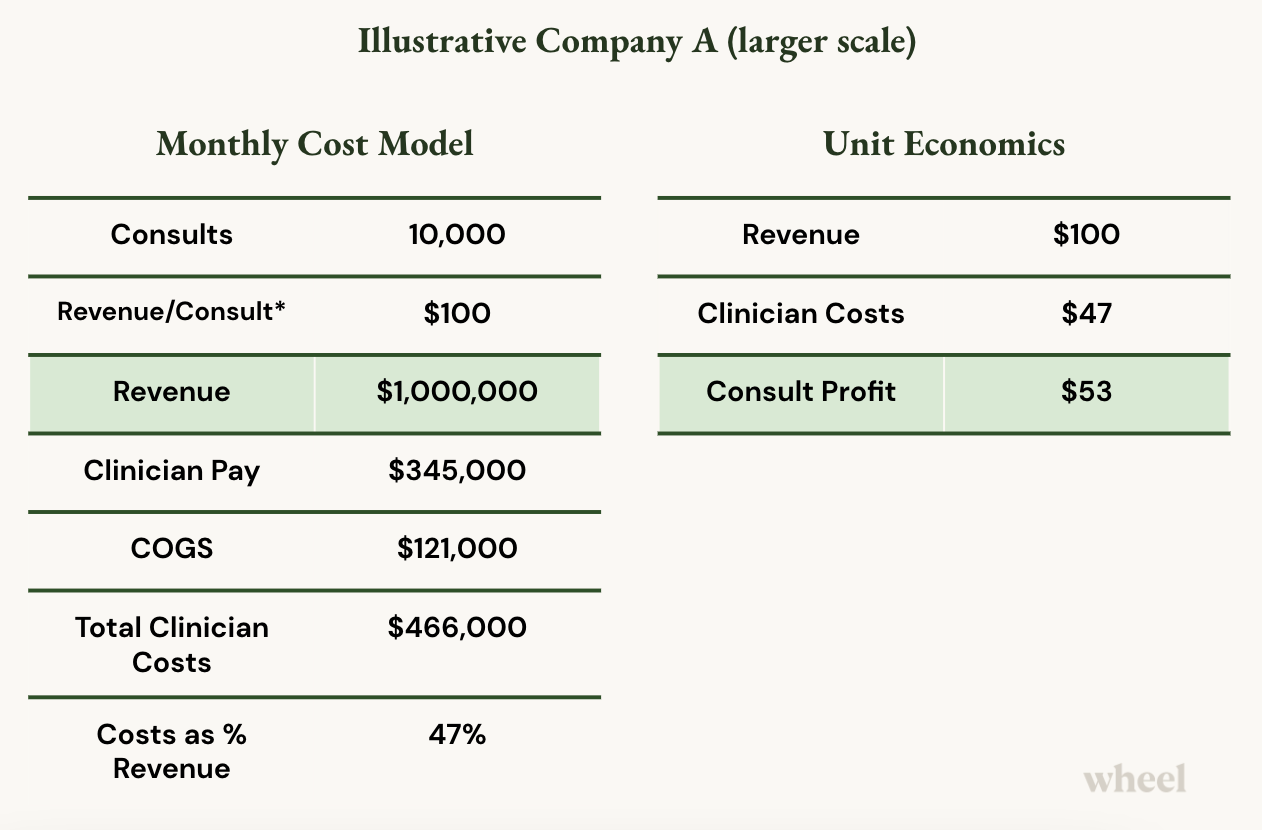

Let’s break down Company A’s costs at scale.

Consults: Now, this company is servicing 10,000 consults per month.

Revenue: Their revenue per consult is still about $100 (reimbursed visits), so they’ve reached $1MM in revenue per month.

Clinicians: At higher volumes and scale, they only need to increase their clinicians by about 3x

Operating Hours: They’re still open 7am - 7pm and 7 days/week.

Clinician Compensation: They spend $345,000 per month for hourly clinician compensation.

COGS: They spend ~$121,000 on licensing, benefits, and other clinical workforce management costs.

Now that their clinicians are busier and better utilized (i.e. not sitting around idly being paid to wait for sporadic consults), clinician pay and COGS as a percentage of their revenue decrease from 167% to just 47%.

Now, Company A makes $53 on each patient visit (before opex).

Great! This company has successfully achieved virtual care ROI!

But how long does it actually take companies to reach profitability nirvana?

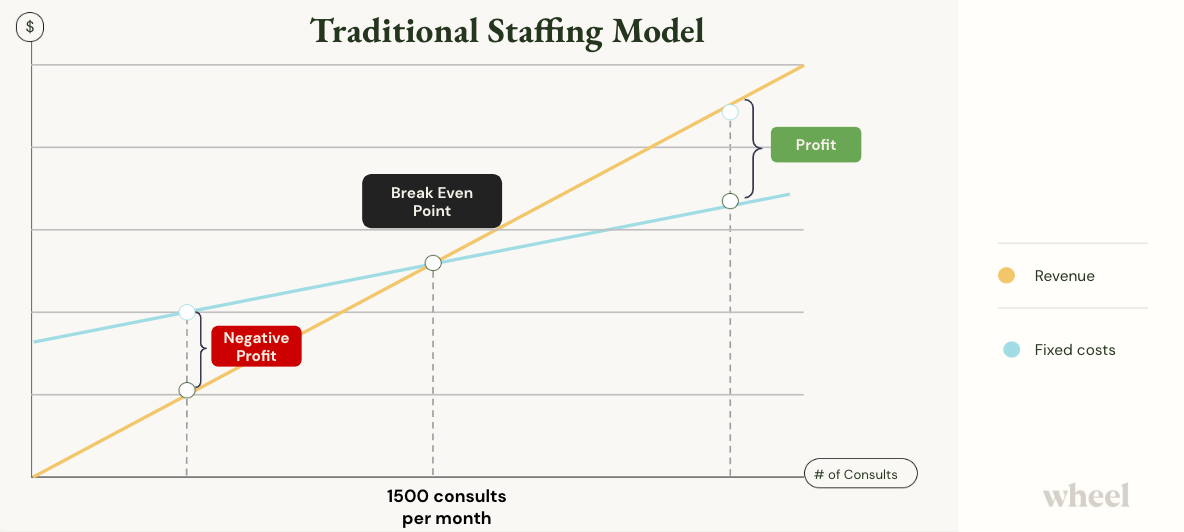

Reaching the ROI breaking point

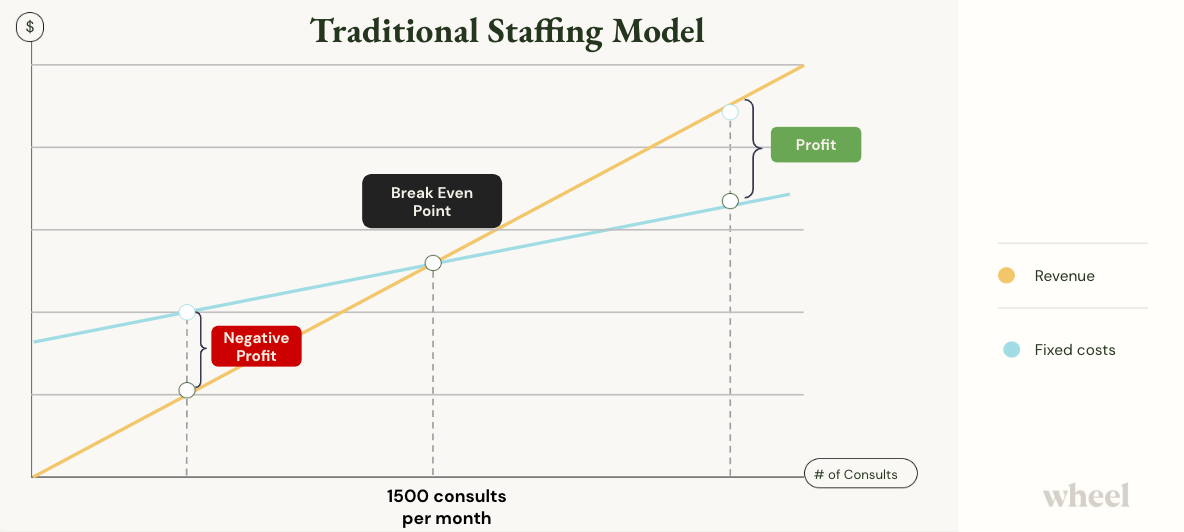

There are too many variables to list that can influence a service’s success, so here we’ll simply focus on the numbers. What patient volume would Company A need to achieve to break even? And how long might that take?

In this example, Company A would need to reach 1,500 patient visits per month to break even. This is before operating expenses and overhead.

Meanwhile, Company A’s competitors have been profitable for a while, powering ahead, investing in patient acquisition, capturing consumer market share, and building brand loyalty.

[Again, it should be noted that this is all based on the assumption that Company A is leveraging a reimbursement model. For cash pay, revenue per consult is much lower, and time to profitability could be significantly longer as it requires much higher patient volumes.]

Achieving profitability (ROI) in virtual care — faster

It’s not impossible to reach profitability at service launch. In our experience supporting and launching telehealth delivery for companies of all sizes and maturity levels, the companies that realize ROI the quickest have figured out what services to outsource from the jump. Specifically, any function that is not core to their business of providing patient care.

As we outlined above, clinical workforce costs make up the bulk of clinician staffing expenses. This includes clinician salaries, clinician management costs, regulatory costs, and the costs of medical operations.

The key to profitability lies in paying for care, not paying for clinicians.

What do we mean by this?

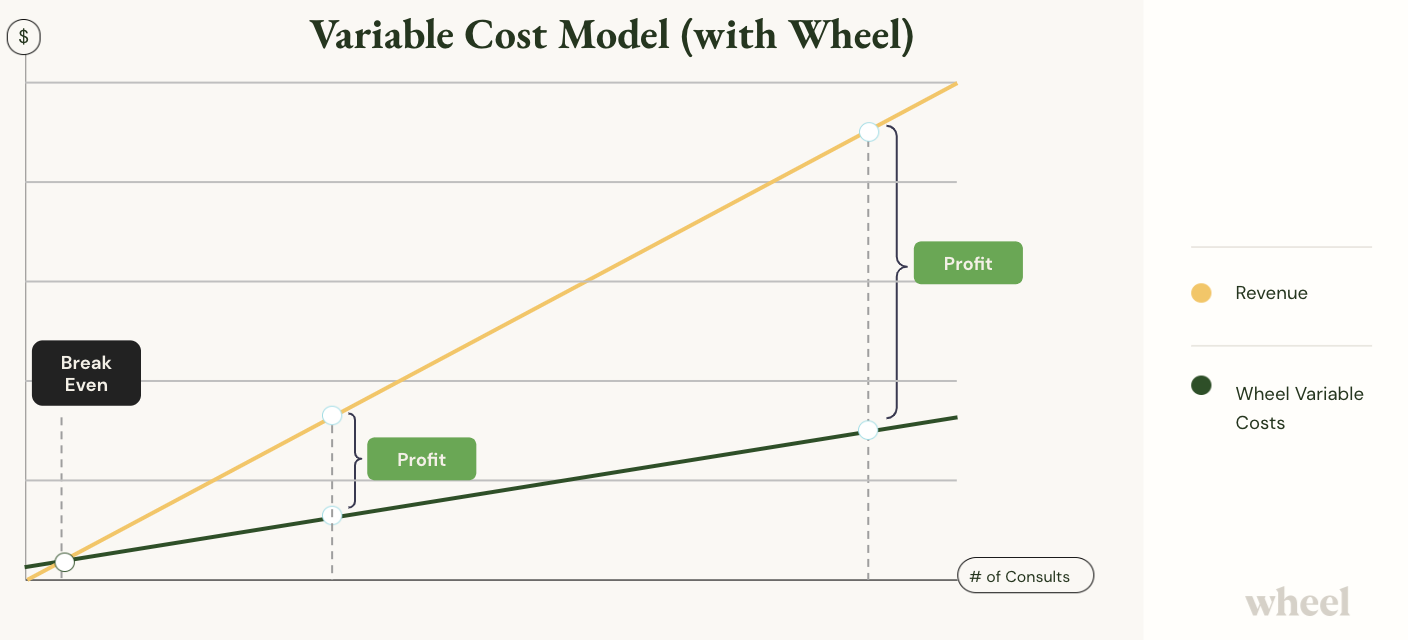

When companies move from fixed clinician costs to a variable cost model, they only pay for the clinicians they need when patient demand requests it.

Companies like Wheel enable this dynamic staffing and cost model, allowing companies to keep overhead lean and achieve profitability almost immediately. (For more on this, check out our article on reducing operating expenses in virtual care.)

To illustrate this, let’s compare what Company A’s profitability looks like before and after Wheel.

Before Wheel

After Wheel

Note the profit margin is significantly increased and revenue is achieved nearly instantly with Wheel.

Wheel beats Company A’s gross margin almost immediately after implementation and later at scale.

The economics of this company are flipped on its head – especially when they are just getting started. Now, this company that’s making $100K in revenue doesn’t have to worry about staffing.

- Acquiring clinicians and managing churn? Offloaded.

- Scheduling shift hours? Taken care of.

- Balancing clinicians with demand? No longer a problem.

Wheel dynamically adjusts the clinical workforce (clinician supply) to patient demand, so clinician pay goes from 167K to 40K. By ‘right sizing’ their cost structure, Wheel frees up profit to invest in their core business.

And perhaps most importantly, the headaches and internal resources required to sustain and manage a clinical workforce at scale are completely offloaded, allowing this company to focus on it’s core - providing great patient care and experiences

So, on a unit economics basis, this company went from losing $67 for every consult to achieving $60 in profit. With that $60 in profit they can invest further in R&D and other headquarter costs, invest in their patient experience, invest in scaling to new markets, and completely change their business.

This is how you build a world-changing business in virtual care.

Wheel client case study

Now that we’ve unpacked the unit economics in virtual care delivery, let’s look at how a Wheel client was able to save 93% per patient visit and more than $1.2 million over 7 months.

Meet the client

This national healthcare company delivers a uniquely seamless experience — with virtual and in-person appointments, primary care, urgent care, and mental health care — to meet patients where they are and provide comprehensive care.

Wheel augments this company’s existing clinician network with clinical coverage for daytime scheduled synchronous video visits in 23 states. Wheel clinicians provide urgent and primary care treatment for common conditions including UTIs, cold and flu, STIs, and medication refills.

The challenge

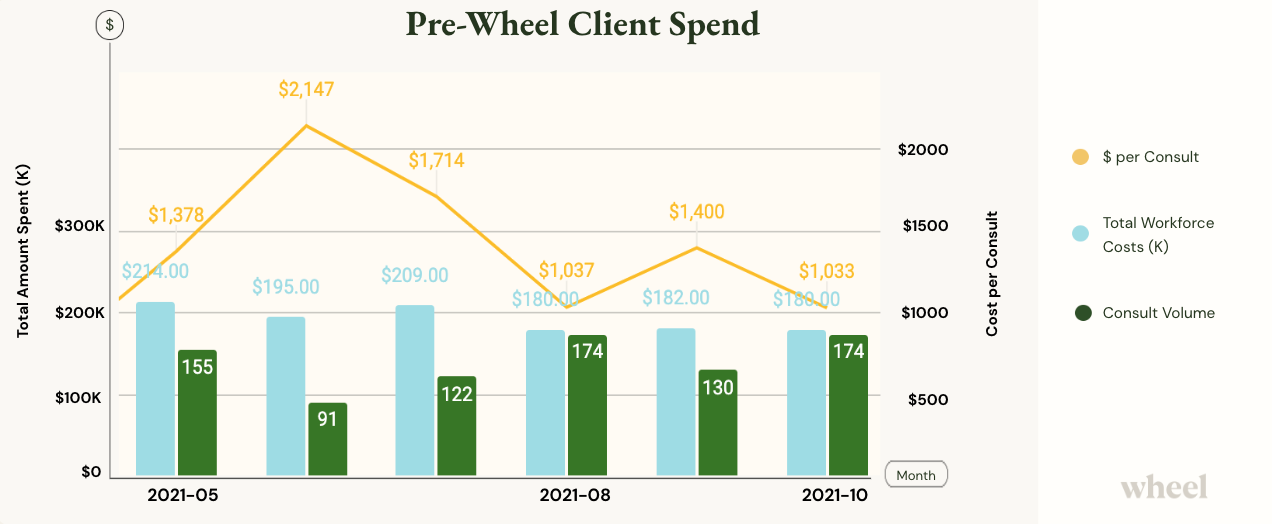

Prior to November of 2021, this client was operating with a traditional staffing model — paying hourly for telehealth clinicians and guessing the best they could about how to predict volume and staff accordingly.

Costs were through the roof and the service was not profitable. They also faced a capacity ceiling, only servicing about 200 consults per month.

With their maximum capacity limits reached and cost per consult at an unsustainable level, this client faced a growth challenge.

The Wheel solution

Even at scale, we see time and again that hourly cost models in telehealth can not match the savings gained with a service like Wheel. Even if companies can afford unlimited people and budgets, with hourly payment models there are always efficiency gaps and productivity caps.

Adopting a variable cost model with usage-based pricing, (also known as a pay-per-consult model) was the key for this company to achieve profitability and business growth.

The Wheel clinician network was layered onto the clients’ existing clinical staff to provide flexible coverage and the client paid just for the clinicians they needed ‘on demand’.

Wheel technology matched patients to the right clinician across Wheel’s large clinician network, and the company was able to offload nearly all staffing management and overhead.

The results

Almost immediately upon implementation with Wheel, the cost per consult decreased exponentially, resulting in a 93% savings in per consult costs. In other words, this company’s per consult profitability increased by 93%. With Wheel’s additional workforce, they were also able to increase volume capacity.

Total savings was $1.23 MM on clinical staffing costs after 7 months of working with Wheel.

This is what a world-changing business model looks like.

The Value of Wheel

Instead of thinking about how many human beings are needed to deliver care, companies should be thinking about how many patient interactions they can serve.

Our service fundamentally changes the virtual care delivery problem from how to economically deliver care to how to drive growth.

Right-size your cost structure, achieve profitability quicker, and offload the headaches of clinical staffing and management with Wheel.

If you’d like to learn more, let’s chat. sales@wheel.com

Further Reading